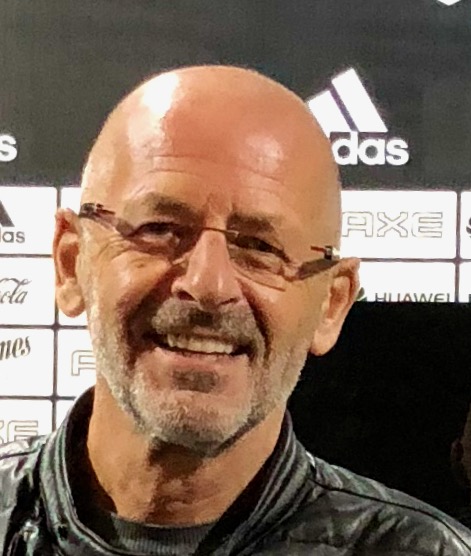

Professor John Thornton

Emeritus Professor

11 - 20 out of 66Page size: 10

- Article › Research › Peer-reviewed

- E-pub ahead of print

Do M&As impact firm carbon intensity?

Altunbas, Y., Khan, A. & Thornton, J., 25 Nov 2023, (E-pub ahead of print) In: Energy Economics. 127, 7, 12 p.Research output: Contribution to journal › Article › peer-review

- Published

Do better-capitalized banks lend less? Evidence from European banks

Altunbas, Y., Di Tommaso, C. & Thornton, J., May 2016, In: Finance Research Letters. 17, p. 246-250Research output: Contribution to journal › Article › peer-review

- Accepted/In press

Do female CEOs handle crises better? Evidence from the COVID-19 pandemic+

Vasilakis, C. & Thornton, J., 29 Apr 2024, (Accepted/In press) In: Economics and Business Letters.Research output: Contribution to journal › Article › peer-review

- Published

Do fiscal responsibility laws matter? Evidence from emerging market economies suggests not.

Thornton, J. S. & Thornton, J., 1 Jun 2009, In: Journal of Economic Policy Reform. 12, 2, p. 127-132Research output: Contribution to journal › Article › peer-review

- Published

Do fiscal rules reduce government borrowing costs in developing countries?

Thornton, J. & Vasilakis, C., 13 Oct 2020, In: International Journal of Finance and Economics. 25, 4, p. 499-510Research output: Contribution to journal › Article › peer-review

Do personal connections improve sovereign credit ratings?

Klusak, P., Thornton, J. & Uymaz, Y., Mar 2020, In: Finance Research Letters. 33, 101194.Research output: Contribution to journal › Article › peer-review

- Published

Does financial development reduce corruption?

Altunbas, Y. & Thornton, J. S., 1 Feb 2012, In: Economics Letters. 114, 2, p. 221-223Research output: Contribution to journal › Article › peer-review

- Published

Does inflation targeting increase income inequality?

Altunbas, Y. & Thornton, J., 28 Jul 2022, In: Journal of Post Keynesian Economics. 45, 4, p. 558–580 23 p., 4.Research output: Contribution to journal › Article › peer-review

- Published

Does inflation targeting reduce sovereign risk? Further evidence

Thornton, J. & Vasilakis, C., Aug 2016, In: Finance Research Letters. 18, August, p. 237-241Research output: Contribution to journal › Article › peer-review

- Published

European Banking Union and bank risk disclosure: the effects of the Single Supervisory Mechanism

Altunbas, Y., Polizzi, S., Scannella, E. & Thornton, J., 15 Jul 2021, In: Review of Quantitative Finance and Accounting.Research output: Contribution to journal › Article › peer-review